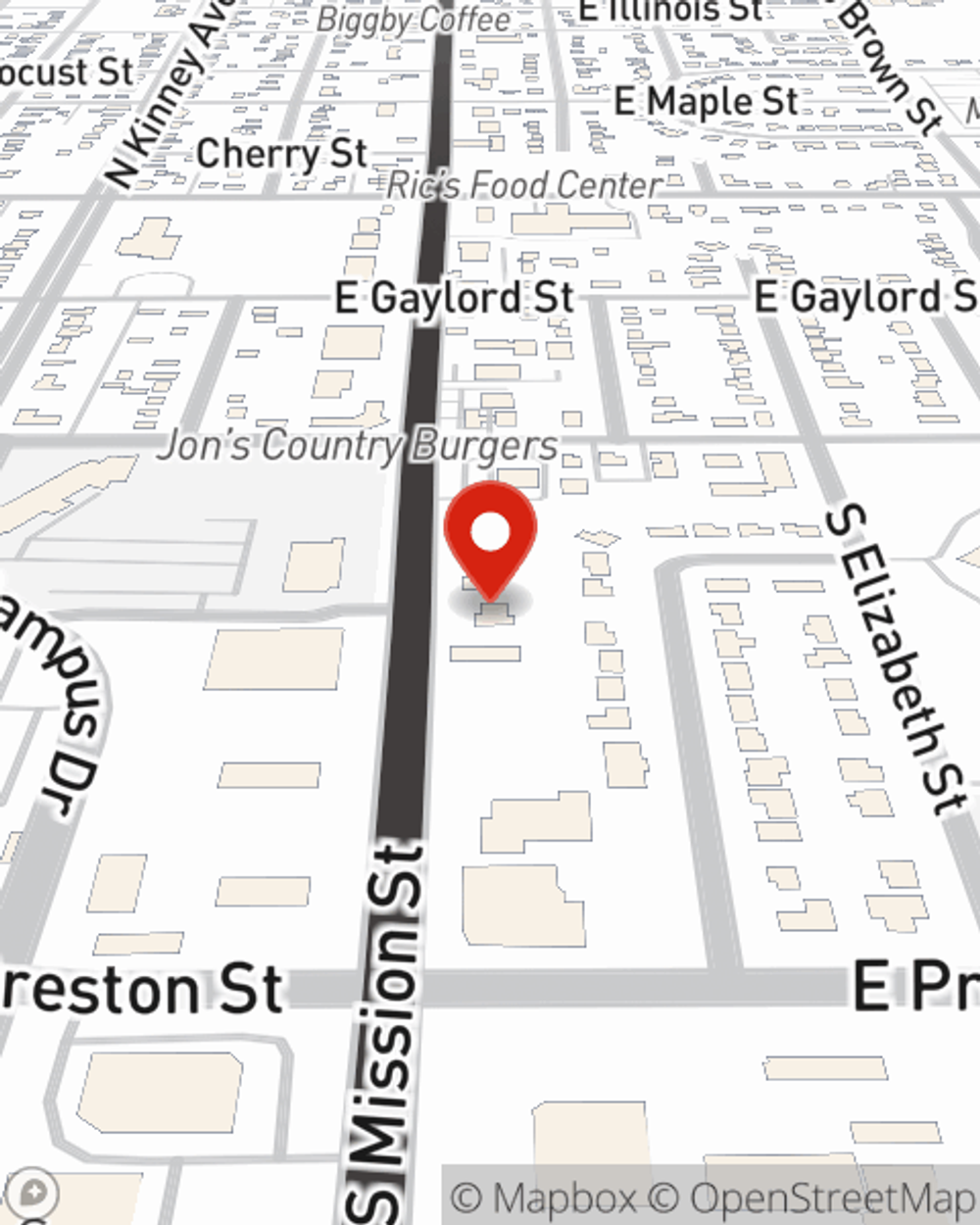

Life Insurance in and around Mt Pleasant

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Midland

- Clare

- Oxford

- Coleman

- Big Rapids

- Canadian Lakes

- Freeland

- sanford

- Beaverton

- Shepherd

- Lansing

- Cadillac

- Reed City

- stanwood

- morley

- alma

- ithaca

- breckenridge

- auburn

- st louis

- hemlock

- traverse city

- grand rapids

- lake city

Check Out Life Insurance Options With State Farm

Investing in those you love is an honor and a joy. You help them make decisions listen to their concerns, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Put Those Worries To Rest

Fortunately, State Farm offers several policy choices that can be personalized to correspond with the needs of your loved ones and their unique situation. Agent Ryan Schlicht has the deep commitment and service you're looking for to help you pick a policy which can assist your loved ones in the wake of loss.

Interested in exploring what State Farm can do for you? Reach out to agent Ryan Schlicht today to get to know your unique Life insurance options.

Have More Questions About Life Insurance?

Call Ryan at (989) 773-9586 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Ryan Schlicht

State Farm® Insurance AgentSimple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.