Business Insurance in and around Mt Pleasant

Mt Pleasant! Look no further for small business insurance.

Almost 100 years of helping small businesses

- Midland

- Clare

- Oxford

- Coleman

- Big Rapids

- Canadian Lakes

- Freeland

- sanford

- Beaverton

- Shepherd

- Lansing

- Cadillac

- Reed City

- stanwood

- morley

- alma

- ithaca

- breckenridge

- auburn

- st louis

- hemlock

- traverse city

- grand rapids

- lake city

Insure The Business You've Built.

Running a small business is hard work. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of contractors, retailers, trades and more!

Mt Pleasant! Look no further for small business insurance.

Almost 100 years of helping small businesses

Surprisingly Great Insurance

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for business owners policies, builders risk insurance or commercial liability umbrella policies.

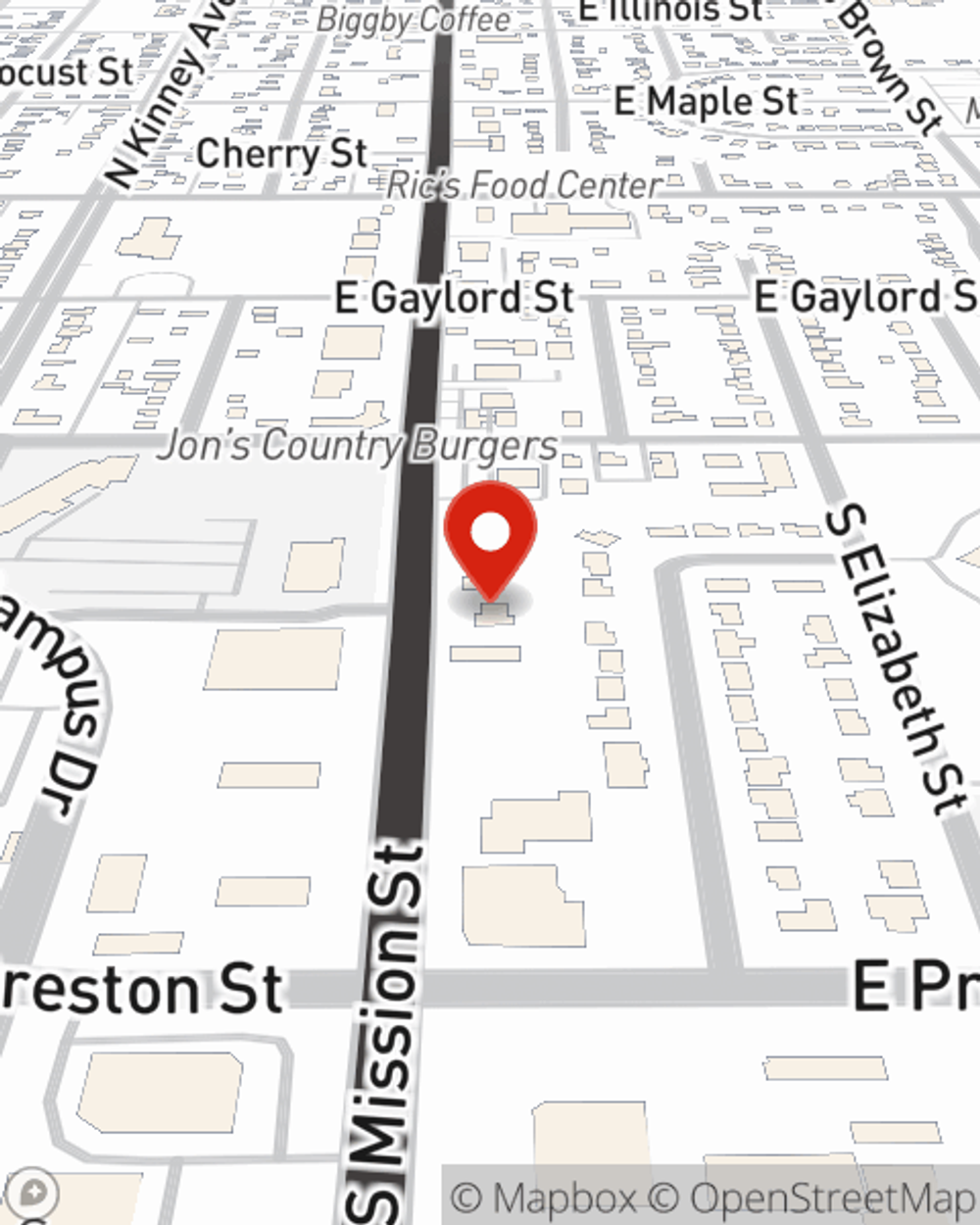

The right coverages can help keep your business safe. Consider reaching out to State Farm agent Ryan Schlicht's office today to discuss your options and get started!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Ryan Schlicht

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.